us exit tax green card

Someone who is a US. If the expatriate is under 59 12 then the earnings are taxable the exceptions listed above are usually inapplicable to expatriation.

Us Exit Tax Giving Up Us Citizenship Or Green Card The Wolf Group

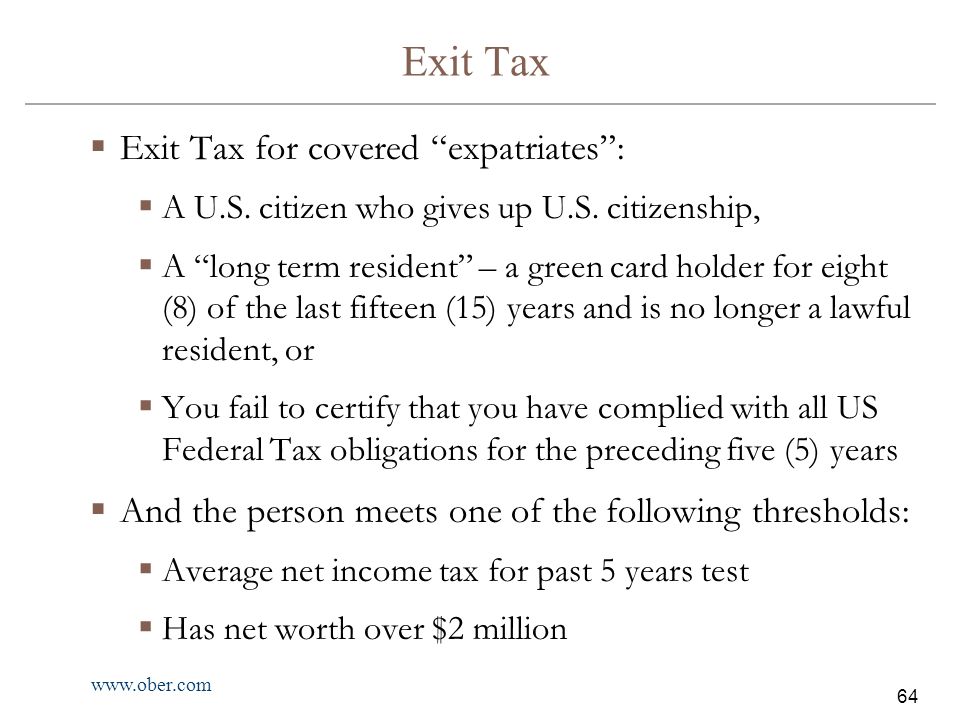

Covered Expatriates and the Exit Tax.

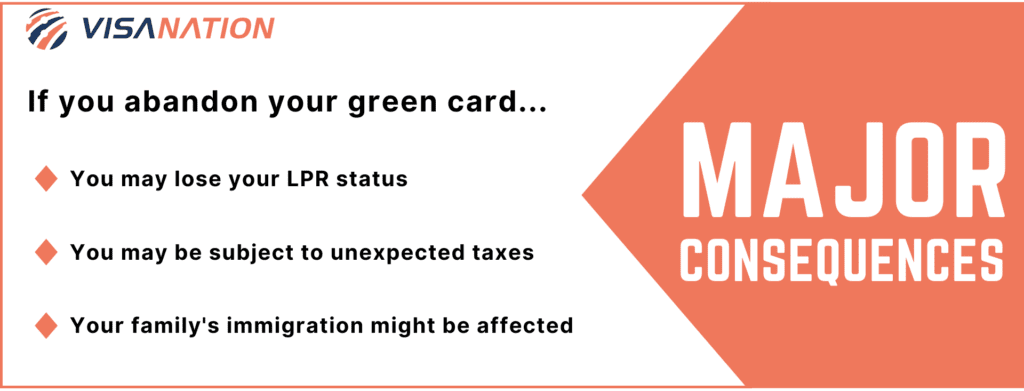

. The mark-to-market tax does not apply to the following. For Green Card holders to be subject to the exit tax they must have been a lawful permanent resident of the Unites States in at least 8 taxable years during a period of 15 taxable. If you are neither of the two you dont have to worry about the exit tax.

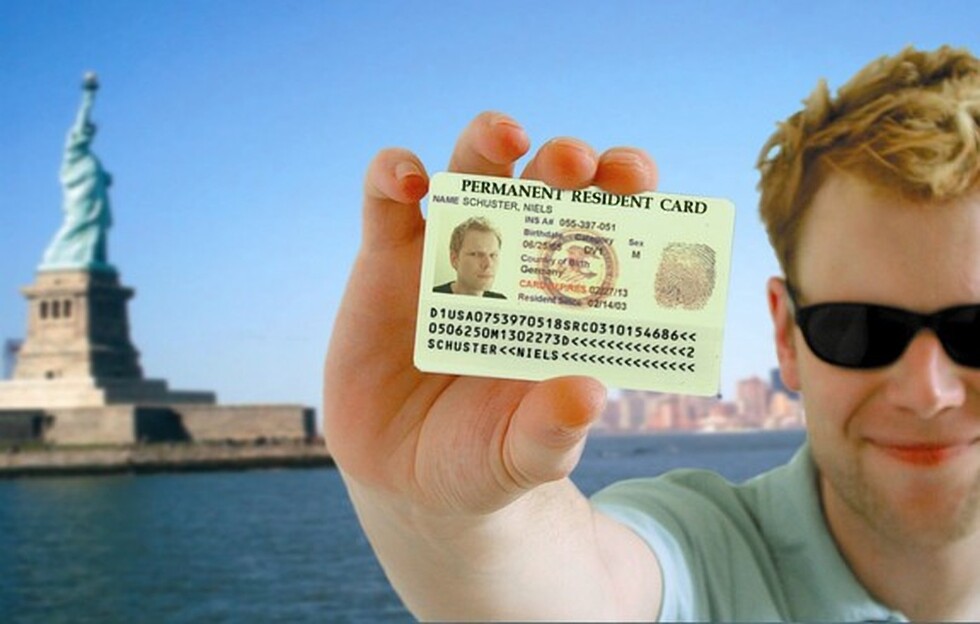

Citizens who have renounced their. Giving Up a Green Card. By giving up citizenship they become expatriates under the IRC.

In the context of US personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up their US citizenship or. If you make the election to be a nonresident of the United States for income tax purposes you risk triggering the exit tax. Giving Up a Green Card US Exit Tax.

The US has enacted an Exit Tax that prevents US citizens and green card holders from giving up their residency in order to avoid paying US taxes on accumulated wealth. Not everyone is taxed as they leave. When a US person gives up their green card it can be a very complicated ordeal from an IRS tax perspective.

A long-term resident is. Only green card holders are taxed. For 2019 the net gain that you otherwise must include in your income is reduced but not below zero by 725000.

If 59 12 or over the Covered. Citizens or long-term residents. For many Legal Permanent Residents once they learn about the IRS tax liabilities for being a Green Card Holder along with the potential.

You are a long-term resident. Taxpayer because of spending too many days in the United States can. Roth IRA Under 59 ½ Years Old.

Citizens of the United States trigger the exit tax rules when they voluntarily or involuntarily terminate that status. The expatriation tax rule only applies to US. The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US.

Your risk exists if. Exit tax applies to. Certain individuals who give up their US citizenship or their green cards are subject to the so-called exit tax imposed under Section.

Exit Tax is a tax paid on a percentage of the assets that someone who is renouncing their US citizenship holds at the time that they renounce them.

Renouncing Us Citizenship Expat Tax Professionals

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Renouncing Us Citizenship Expat Tax Professionals

Green Card Holders Staying Abroad Over 6 Months Risk Abandonment

Green Card Holder Exit Tax 8 Year Abandonment Rule New

How To Renounce A Us Green Card Gracefully Expat

Once You Renounce Your Us Citizenship You Can Never Go Back

Indian Citizenship For Us Born Child Benefits Problems Usa

1 Third Annual Presentation Hot Irs Topics Affecting Us Citizens Green Card Holders Living In Israel And Abroad May 21 2013 Tax Seminar Ppt Download

Us Exit Tax Rules For Green Card Holders Archives U S Citizens And Green Card Holders Residing In Canada And Abroad

Irs Exit Tax For U S Citizens Explained Expat Us Tax

Us Expatriation Tax Services Us Tax Financial Services

It Pays To Be Honest Disclose Foreign Assets As Gc Holders Otherwise

Basics Of Us Exit Tax 1 Taxation For Green Cardholders Navigating Cross Border Lifestyle Youtube

3 Green Card Abandonment Consequences Ways To Reinstate